Individuals who make an annual employment income of RM26501 after deducting EPF contributions or more are required to register a tax file as of the fiscal. Here are the 2-step process for your tax registration in Malaysia.

How To Step By Step Income Tax E Filing Guide Imoney

Companies limited liability partnerships trust bodies and cooperative societies which are dormant andor have not commenced business are required to register and furnish Form E with effect from Year of Assessment.

.png)

. 21 Copy of Identity card for Malaysian Citizen permenant resident or passport for non Malaysian citizen. RM9000 for individuals. Income Tax Number Registration.

23 Passport and business registration certificate for non-citizen. Sales tax fully waived for new passenger vehicles. Unregistered companies with IRBM.

To check whether an Income Tax Number has already been issued to you click on Semak No. Company Tax Deduction 2021. Amending the Income Tax Return Form.

Individual who has income which is taxable. If youve just entered the workforce and have absolutely no idea how all this works heres a handy guide on how to file your taxes for the first time. First is to determine if you are eligible as a taxpayer 2.

Browse to ezHASiL e-Filing website and click First Time Login. 19 TaxOther balance. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Click on the e-Daftar icon or link. File your income tax online via e-Filing 4. Keep track of your income.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing. Both residents and non-residents are taxed on income accruing in or derived from Malaysia.

It takes just four steps to complete your income tax number registration. Check reliefs and exemptions. Those who are to be taxed for the first time must register an income tax reference number before proceeding as mentioned above.

To do so your employee can do the following. For further information consult the dedicated page on the official website of the Inland Revenue Board of. Latest salary statement payslip.

They need to apply for registration of a tax file. The following entities and accounting firms in Malaysia must file their taxes. Click on the borang pendaftaran online link.

A business or company which has employees and fulfilling the. LEMBAGA HASIL DALAM NEGERI MALAYSIA HASiL ANJUR PERSIDANGAN PERCUKAIAN KEBANGSAAN 2022 KALI KE-22. Maximising your tax relief and rebates to get your money back 6.

Do you need to file your taxes. Special Income Remittance Program PKPP For Malaysian Tax Resident With Foreign Sourced. Fill up PIN Number and MyKad Number click Submit button.

A businessperson with taxable income. Visit the official Inland Revenue Board of Malaysia website. Information on Taxes in Malaysia.

Malaysia has implementing territorial tax system. Foreign income remitted into Malaysia is exempted from tax. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Click on ezHASiL. Lets take a look at the registration steps. Go through the instructions carefully.

Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference. An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia. 24 Tax Tax for individual.

Register at the nearest IRBM Inland Revenue Board of Malaysia or LHDN Lembaga Hasil Dalam Negeri branch OR register online via e-Daftar. Ensure you have your latest EA form with you 3. Personal income tax rates.

Do I need to register for income tax Malaysia. 100 exemption on import and excise duties sales tax and road tax for electric vehicles. All types of income are taxable in Malaysia.

Register Online Through e-Daftar. An employee who is subject to monthly tax deduction. Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021.

Please complete this online registration form. Review all the information click Agree Submit button. If paid up capital is less than RM 25 million 1st RM ½ million.

Where a company commenced operations. An individual who earns an annual employment income of RM25501 after deducting EPF contributions or more is required to file a tax return. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

When registering the taxpayer is required to bring along the following items. If your employee is newly taxable heshe must register an income tax reference number. Up to RM3000 for kindergarten and daycare fees.

Taxable income MYR Tax on column 1 MYR Tax on excess Over. Please upload your application together with the following document. You need to pay tax If your income is over RM 34000 per year Individual tax rate is 28.

Read Also The sales and service tax SST in Malaysia. In Malaysia income tax is compulsory by law and the income tax you pay differ based on your total taxable income for the year. A Malaysian individual must register a tax file if they.

22 Business registration certificate for Malaysian citizen who carries on business. Who must register Income Tax File. Click on e-Daftar.

Fill in your forms. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. Verify your PCBMTD amount 5.

7 Tips To File Malaysian Income Tax For Beginners

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog

Business Income Tax Malaysia Deadlines For 2021

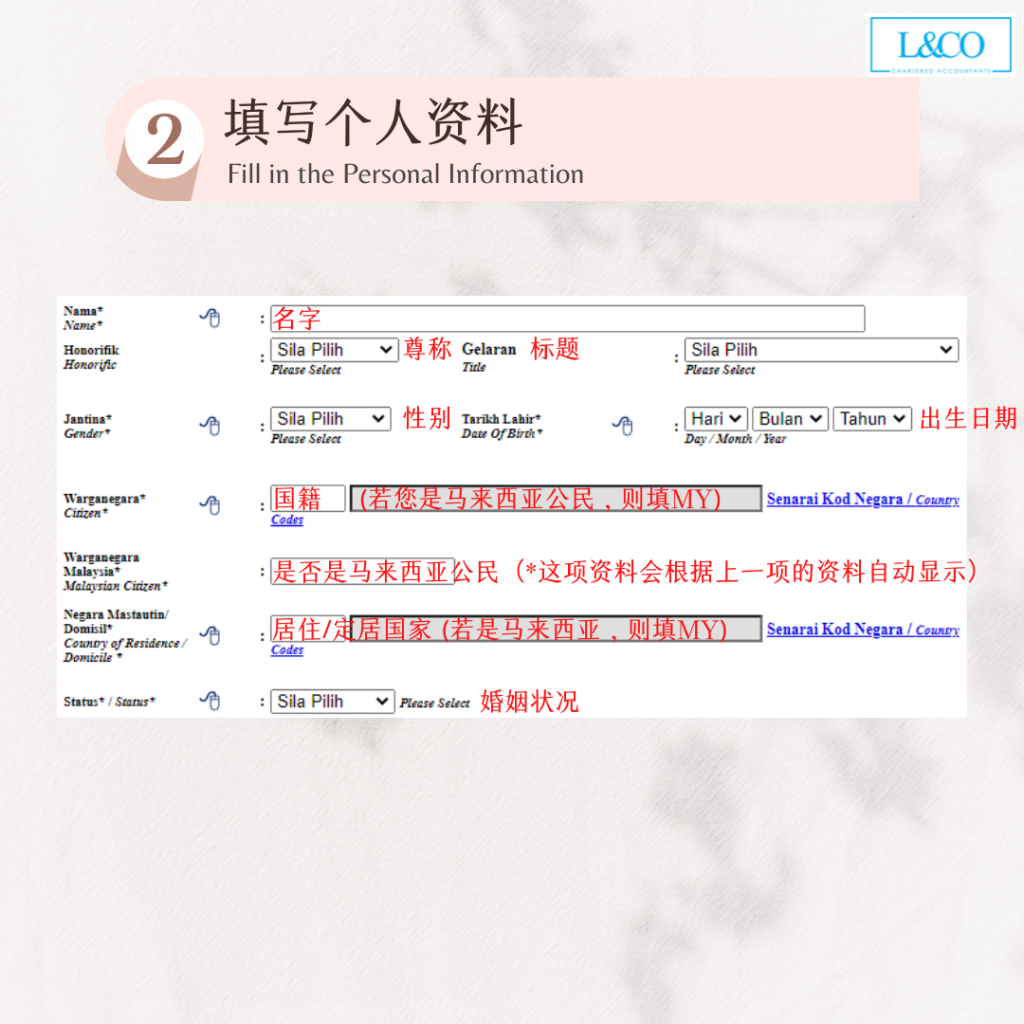

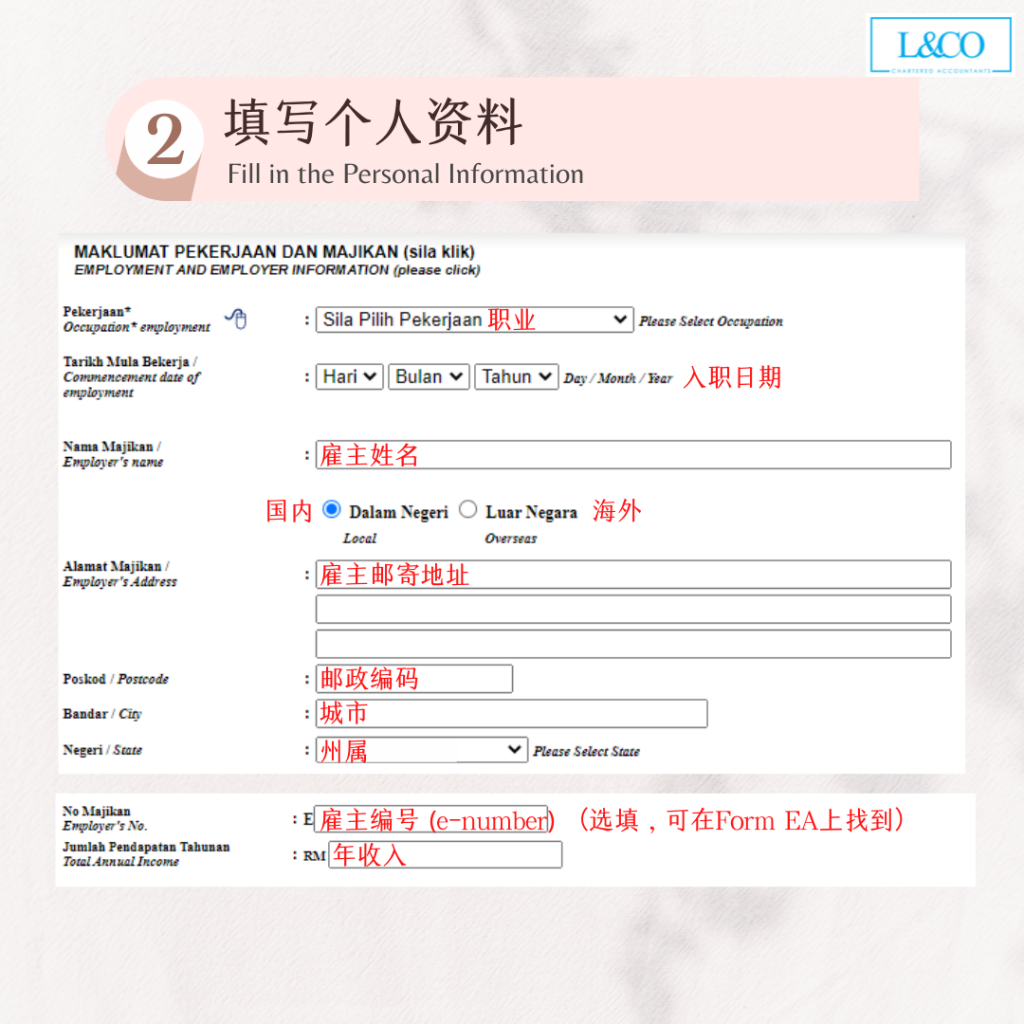

Income Tax Number Registration Steps L Co

Income Tax Number Registration Steps L Co

How To File Your Taxes For The First Time

Income Tax Number Registration Steps L Co

Income Tax Number Registration Steps L Co

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To Register As A Taxpayer For The First Time In 2022

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

.png)

How To Check Your Income Tax Number

Business Income Tax Malaysia Deadlines For 2021

7 Tips To File Malaysian Income Tax For Beginners